How does this entire investment process work? First, as background, in 2012 President Obama signed the JOBS (Jumpstart Our Business Startups) Act as a means of stimulating job growth in the private sector. Reg A+ is officially part of this act as Title IV of the JOBS Act and went into effect on June 19, 2015. Reg.A+ allows companies to raise up to $20MM and $50MM from investors from what is called “Tier 1” and “Tier 2” offerings.

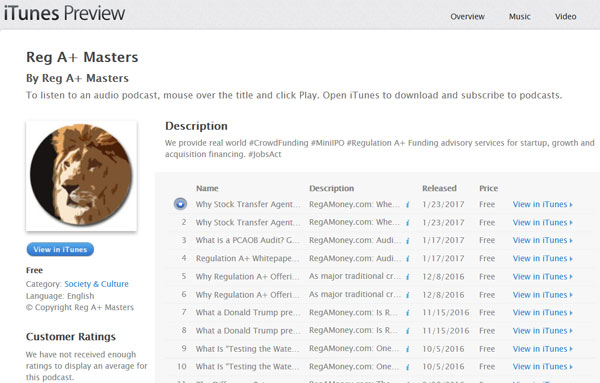

Listen to the Reg.A Money Show and stay current on the latest Reg.A+ information and trends!

There are many steps involved in a Regulation A+ offering, which differs from a traditional IPO on many aspects, the most important being the ability to present these deals to investors of all shapes and sizes, as well as relaxed requirements on how to promote each deal.

When the Reg.A+ offering becomes “qualified” with the SEC, the Regulation A+ offering becomes official and begins to accept investor money. One of the biggest attributes of Reg.A+ is that many of these investors can be their craft beer drinking customers who already like the business, which is why Reg.A+ is perfect for craft beer brewers since many already have a loyal following of happy evangelists who love their brand to begin with! Turning these customers into investors is a win-win for all involved!

The result of a successful Reg.A+ offering is that the company obtains financing, the investors have freely trading shares of the company, and the company has a trading symbol to trade on. What investors and issuing companies need to understand is although Reg.A+ is new, it is gaining significant momentum and it is a legitimate form of crowdfunding sanctioned by the SEC. In fact, we predict Reg.A+ will quickly become the financing vehicle of choice where traditional IPOs will go by the wayside.

Craft breweries – many who already struggle to obtain venture capital money – have high capital expenditures and would likely obtain high interest rate loans to reach their goals, be it equipment, new development, or expansion. Reg.A+ solves this dilemma… and solves it in a very attractive solution for both brewery and investor.

We at CraftBeerInvestors.com assist craft beer breweries in developing their Reg.A+ strategy and guide them through every step of the SEC qualification process – as well as help market their Reg.A+ offering to craft beer drinkers who want to invest in breweries. Visit www.RegAMoney.com for more Regulation A+ information and related news on Reg.A+